Written by: Moeeza Azeem

Paying back such a large sum causes them misery, and they lose all of their assets in the process. Another issue in today's world is the difficulty of building a house due to high raw material, labour, and property tax costs.

Note: You can start your online teaching business without any investment. See the list of apps you can use for online teaching.

Furthermore, many talented students are left behind due to financial issues and are forced to live in poverty despite their exceptional abilities.

However, many public and private organizations in Pakistan are working to save people from such a challenge. Almost all people's needs are met by organizations that offer interest-free loans.

How to get interest free loan for business in Pakistan?

We will present you with different options and methods for obtaining interest-free loans for your home, business, or studies.

List of Interest free business / Personal loan givers in Pakistan

This list includes all the opportunities for you to explore to find an interest-free loan for your home, business or education.1. Mera Pakistan Mera Ghar Scheme

The GOP and the State Bank of Pakistan (SBP) decided to implement a "Government's Mark up Subsidy Scheme for Housing Finance" to provide low-income people with long-term affordable housing financing.By diminishing Muskhara Mode financing, this scheme provides convenient ways to fulfill your needs to construct and build your house in a complete Shahriah recommended manner.

Terms and Conditions

Housing Finance is available for houses up to 125 Sq. Yards (5 Marla) and up to 250 Sq. Yards (10 Marla), flats/apartments with a maximum covered area of 1,250 Sq. ft. and 2,000 Sq. ft. on a low markup rate per annum (varies from bank to bank), and a person can apply for a subsidized interest-free house loan under this scheme once only.Pricing and Plans

Tier 1: First 5 Years: 3% Next 5 Years: 5% For Loan Tenors exceeding 10 Years: 1Y KIBOR + 2.5%Tier 2: First 5 Years: 5% Next 5 Years: 7% For Loan Tenors exceeding 10 Years: 1Y KIBOR + 4%

Tier 3: First 5 Years = 7% Next 5 Years = 9% For Loan Tenors exceeding 10 Years: 1Y KIBOR + 4

How to apply online?

Visit the official website for more information and filling application official site of NBP.Interest-free loans for businesses and startups

1. Punjab Rozgar Scheme

Following COVID, the Punjab government has been hard at work on various uplift projects, which have now been integrated into a single scheme.The Punjab Small Industries Corporation (PSIC) has introduced the "Punjab Rozgar Scheme" in partnership with The Bank of Punjab, which seeks to provide subsidized small business loans ranging from Rs. 100,000 to Rs. 10,000,000.

The Alkhidmat Mawakhat Program was created with the purpose of assisting the underprivileged in launching a business and improving their level of living by offering interest-free loans (Qarz e Hasna).

How to apply for Punjab Rozgar Scheme?

People between the age of 20-50 can apply for the loans by signing up through their CNICs on the official website of Punjab Rozgar Scheme.2. Alkhidmat Foundation Pakistan Loan

The Alkhidmat Mawakhat Program was created with the purpose of assisting the underprivileged in launching a business and improving their level of living by offering interest-free loans (Qarz e Hasna).

Loan Range

Al khidmat foundation offer small enterprises loans ranging from PKR 20K to PKR 50K, as well as a Libration Loan of up to PKR 50,000.

How to Apply for Al khidmat foundation loan?

Visit the official website for more details and to apply online.3. Kamyab Jawan Program Loan Scheme

The Prime Minister's 'Kamyab Jawan–Youth Entrepreneurship Scheme' aims to give financial help to young entrepreneurs and established enterprises between the ages of 21 and 45 through 21 Islamic, commercial, and SME banks under the supervision and guidance of the State Bank of Pakistan (18 years for the IT sector).

Kamyab Jawan Program's Objective

Kamyab Jawan Program was initiated by Imran Khan's Govt. The program was launched to envision a youth-led Pakistan. Its purpose is to provide loans to young people with entrepreneurial ideas to start their business or invest in a running business.

Loan tiers / limits and plans

The loans are separated into three tiers:

Tiers 1:

Loan range: 1,00000 - 10,00,000

Mark up: 3%

Security: Non

Tier 2:

Loan rage: 10,00,001 - 1,00,00,000

Mark up: 4%

Security: Yes

Tier 3:

Loan rage: 1,00,00,001 - 2,50,00,000

Mark up: 5%

Security: Yes

How to apply for Kamyab Jawan Program Loan?

You can only apply online by visiting this page.

Terms and Conditions and FAQs

You can get more and in-depth information about Kamyab Jawan Program in a separate post.

4. AGAHE Pakistan free business loan

AGAHE is an INGO working in Pakistan. They provide small loans ranging 15,000-50,000. They work with extremely poor communities to support them with finance to start their own small business or enhance their earning.

The loan is paid back in one year with easy monthly installments. For more information visit AGAHE's Official website.

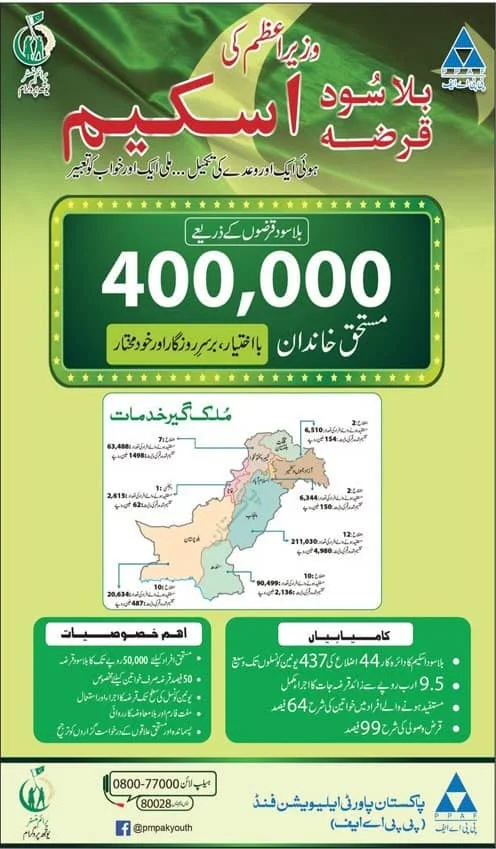

5. PPAF and PM Youth Program Free Loan

Pakistan Poverty Alleviation Fund and Primeminister Youth Program have joined to provide interest-free loans to the youth of the country.

Loan Range and Terms

PPAF and PM youth program offers upto Rs 50,000 Loan for deserving people. The 50% loan is reserved for women only. This is a root-level facility for loans that works at the union council level. you can visit your Union council office to get the application form.

You may also like: